- What are the typical collaterals needed for a Funding Round or a M&A transaction?

Valuation, Teaser, Investment Memo, Equity Story, Pitch-deck

When a business is making rapid transformation or scaling up, it often needs to raise several rounds of capital from various investors groups. These investors have a defined entry and exit strategy in terms of Value Creation. Besides impacting ESG concerns, they also make the equity sweat to achieve the full potential of the business.

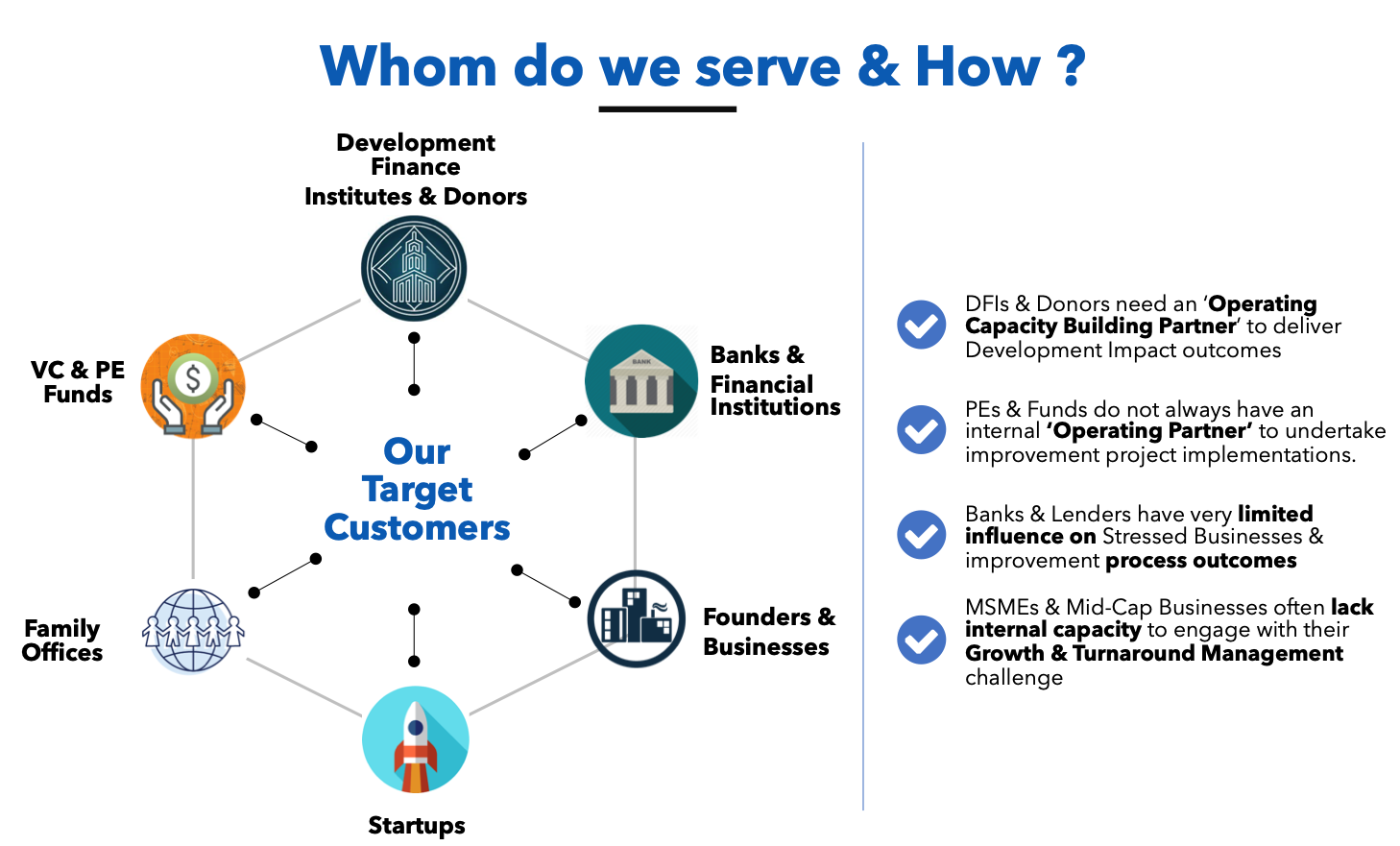

ProConScaleX has particular experience in dealing with different Investor Clusters and is able to appreciate their specific investment requirements from the nature of their Funds and their Investment rationale.

This helps ProConScaleX create the necessary preparedness for businesses that are seeking to raise capital in the short-to-medium term. The following collaterals are prepared along with Management Teams in order to selectively pitch to Investors:

- Strategic Business Plan

- Business Model and Valuation

- Investment Teaser

- Investment Memorandum | Pitch-deck

We have worked on 200+ Advisory Engagements for both Start-ups and Traditional Companies and have covered 40+ industries including Deep-tech, Food & Beverage, Consumer-Tech, Consumer Internet, Retail, Clean-tech, Automotive Retail, Electric Vehicle, Manufacturing, FMCG, Affordable Housing Finance, AI/ML, Health-Tech, Ed-tech, Fin-tech, Fast-Fashion, COCO & FOCO models, D2C Brands, QSR Chains, Lifestyle, Aggregation Model, Space-Tech, Procurement-tech, Agri-tech Bakery Chain, Coal Beneficiation, etc

Transaction Advisory Services for Startups

- Secondary Market Research & Market Sizing

- Macro-Market and Micro-Market Insights

- Deep Industry & Sector Research

- Crafting Customised Equity Growth Stories

- Preparation of Investor Pitch Deck

- Preparation of Investor Memorandum

- Preparation of Company Profiles

- 2 Min Video Pitch

- Preparation of Monthly, Quarterly , Annual Financial Models

- KPI driven exhaustive Business Modelling

- Dynamic Income Statement, Balance Sheet, and Cashflow Projections

- Pre-Money and Post-Money Valuation Advisory

- Comparable Company and Transaction Analysis

- Valuation and Stake Dilution Range

Transaction Advisory for PE/VC Funds

- Transaction Support for Portfolio Companies

- Prepare founders for Future Investment Round

- Preparation of Investor Pitch Deck

- Preparation of Investor Memorandum

- KPI-Driven Cash Flow Modelling Exercise

- Preparation of Monthly, Quarterly and Annual Financial Models

- KPI driven exhaustive Business Modelling

- 2 Min Video Pitch

- Preparation of Monthly, Quarterly , Annual Financial Models

- KPI driven exhaustive Business Modelling

- Dynamic Income Statement, Balance Sheet, and Cashflow Projections

- Scenario and Sensitivity Analysis

- Commercial Due Diligence

- Comparable Company and Transaction Analysis

- Valuation and Stake Dilution Range

Lead Advisory Services

- Investor Profiling

- Investor Targeting based on Company’s Value Proposition

- Investor Reach out

- Pre-Investor call Founder/ Promoter Grooming

- Handing holding every investor discussion

- Handing holding every investor discussion

- Customising Company Data Points based on Investor Requirement

- Data Room Control

- Term Sheet Advisory

- Due Diligence Advisory

- Deal Negotiation

- Deal Structuring

- Legal Advisory

- Shareholder Agreement and Definitive Agreement Advisory